The 21 Million Bitcoin Cap

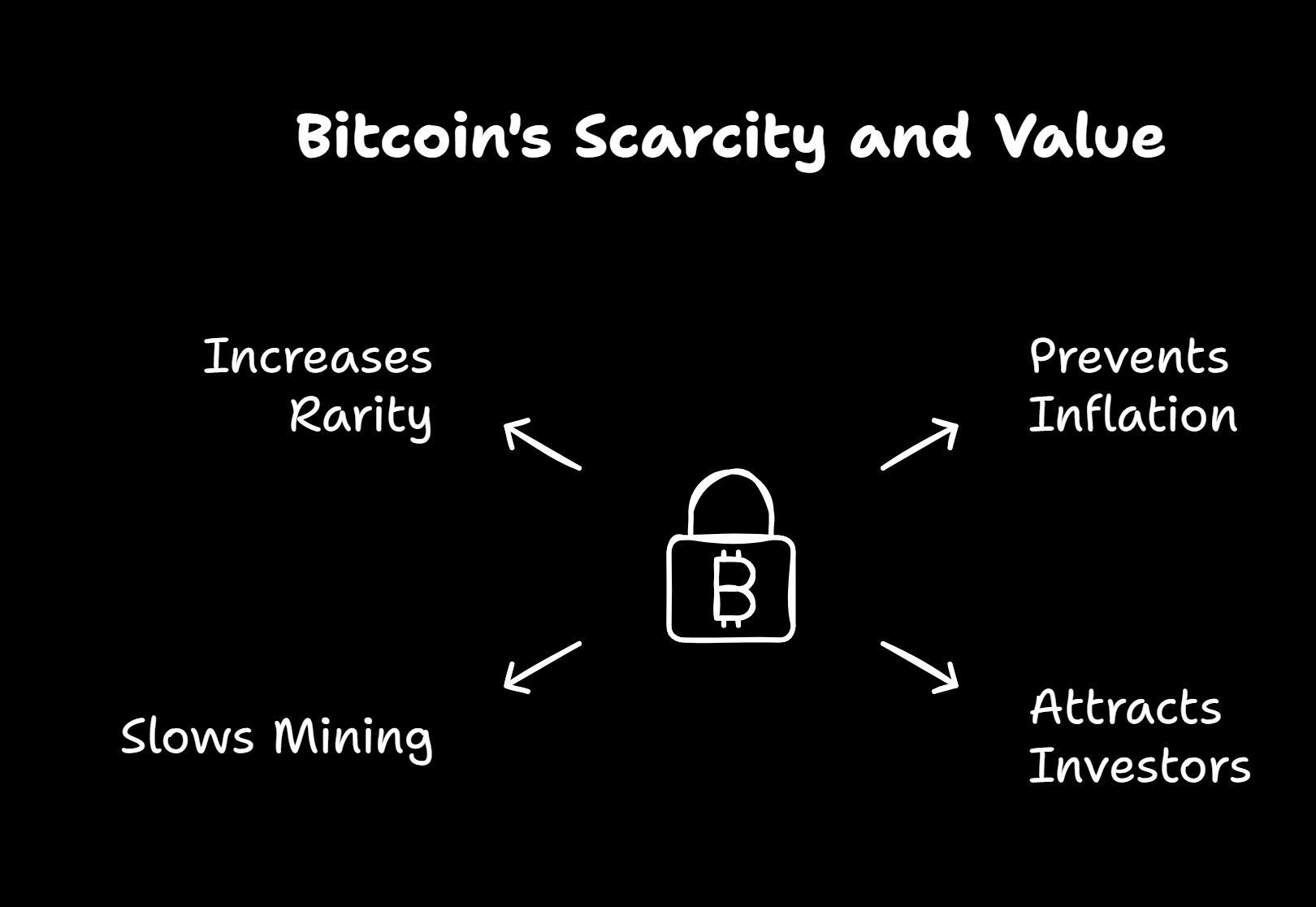

Bitcoin's limited supply of 21 million coins makes it a unique digital asset, similar to a rare collectible that becomes more valuable as demand increases.

Why 21 Million?

Well, it's like a super-exclusive club with a strict guest list. Satoshi Nakamoto, the mysterious creator of Bitcoin, decided to limit the total number of Bitcoins to 21 million...

Think of it like this: traditional currencies can be printed endlessly by central banks, but Bitcoin is different. Its supply is capped, which helps prevent inflation and makes it more attractive as a store of value. Plus, the way new Bitcoins are created—through a process called mining—slows down over time due to something called "halving," which happens about every four years. This reduces the number of new Bitcoins entering circulation, making the existing ones even more precious.

So, why 21 million specifically? Well, that's a bit of a mystery, but it seems to be a combination of mathematical design and a desire to create a predictable, deflationary currency. The result? A digital asset that's as rare as a unicorn and just as coveted.

Market Psychology

Good news can make prices soar, while bad news can send them crashing. It's like a big game of market psychology.

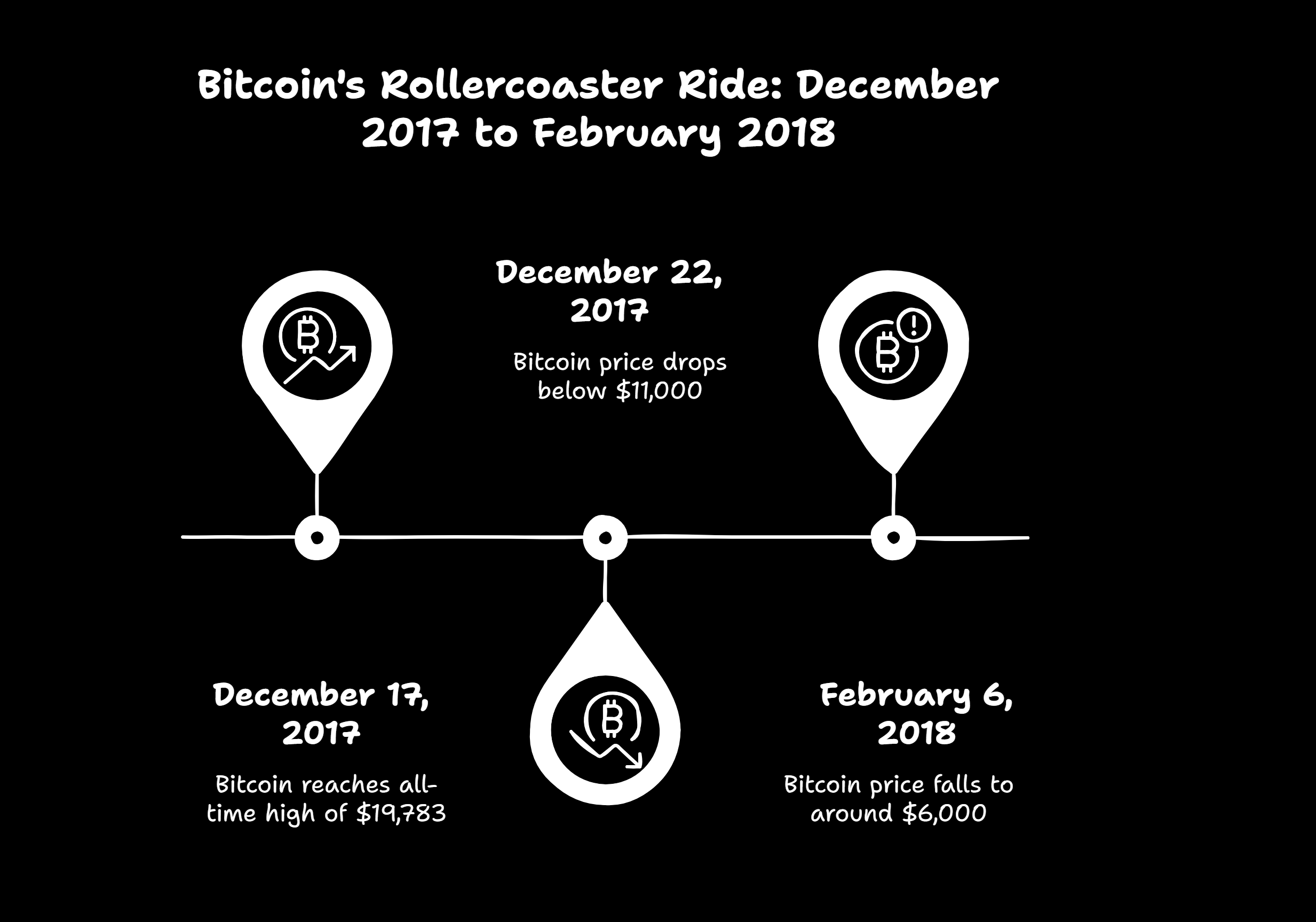

The 2017 Price Rollercoaster

CoinDesk: Down More Than 70% in 2018, Bitcoin Closes Its Worst Year on Record

Imagine you're at a big party and everyone's dancing to the same song... If someone suddenly shouts "Fire!", even if there's no fire, everyone will panic and run out.

This is what happened in December 2017.Bitcoin's price reached an all-time high of about $19,783 on December 17, with everyone celebrating like they were at a New Year's Eve party. However, just five days later, on December 22, the price suddenly plummeted below $11,000, leaving investors in a state of panic. The slide didn't stop there; by February 6, 2018, Bitcoin had dropped to around $6,000. It was like the whole market had hit the pause button, and everyone was frantically selling off their holdings.

Regulatory Impact

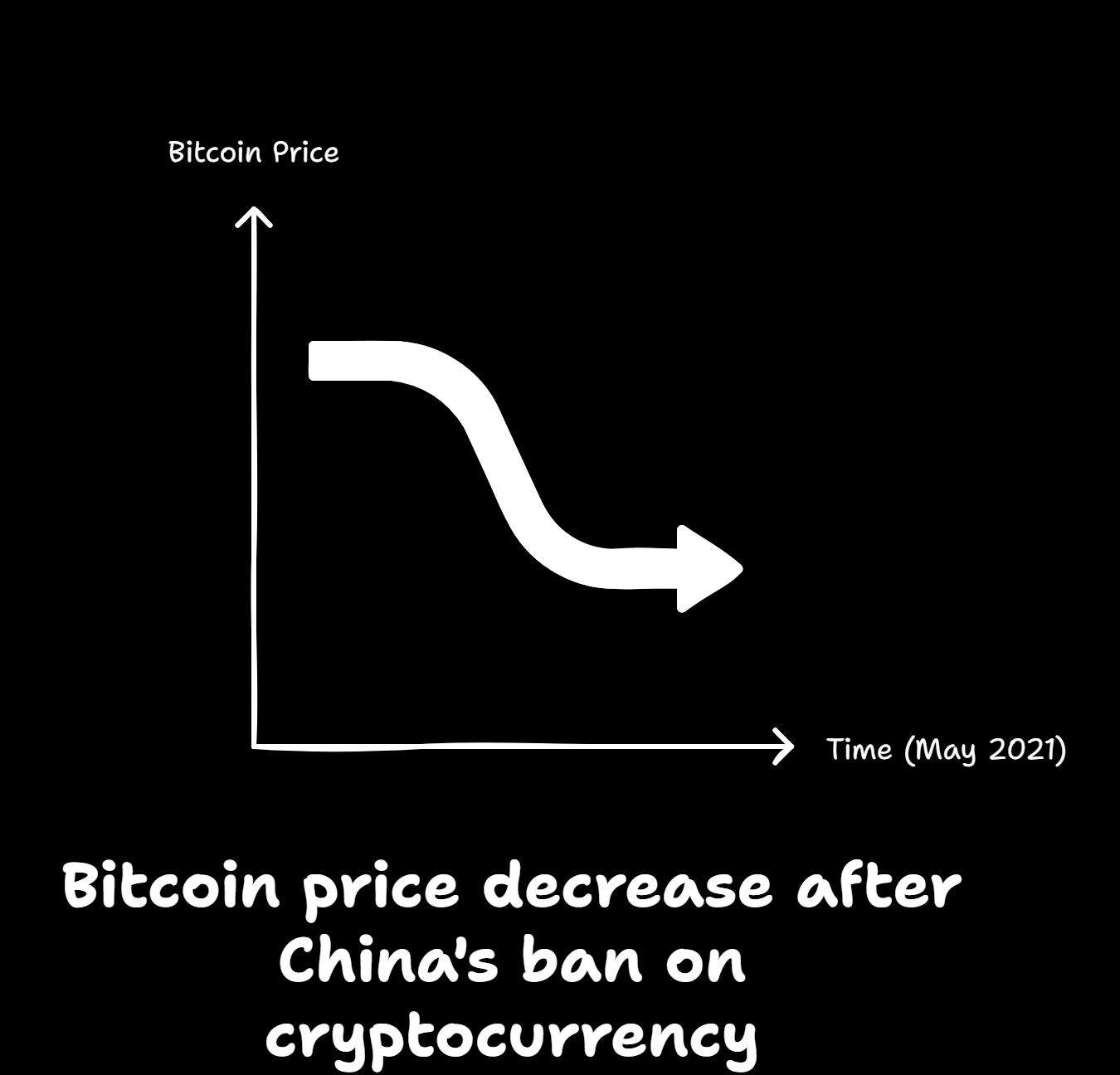

If a country decides to ban or support Bitcoin, it can cause huge price swings overnight. It's like a surprise plot twist in a financial thriller.

China's Crypto Crackdown

REUTERS:China vows to crack down on bitcoin mining, trading activities

Picture this: China announces a crackdown on cryptocurrency mining and trading... It's like the music stops at the party, and everyone freezes. Bitcoin's price sharply drops because investors worry about what might happen next.

This is what happened in May 2021 when China banned cryptocurrency mining, causing Bitcoin's price to fall by 44%. Such regulatory actions can suddenly change the mood of the market.