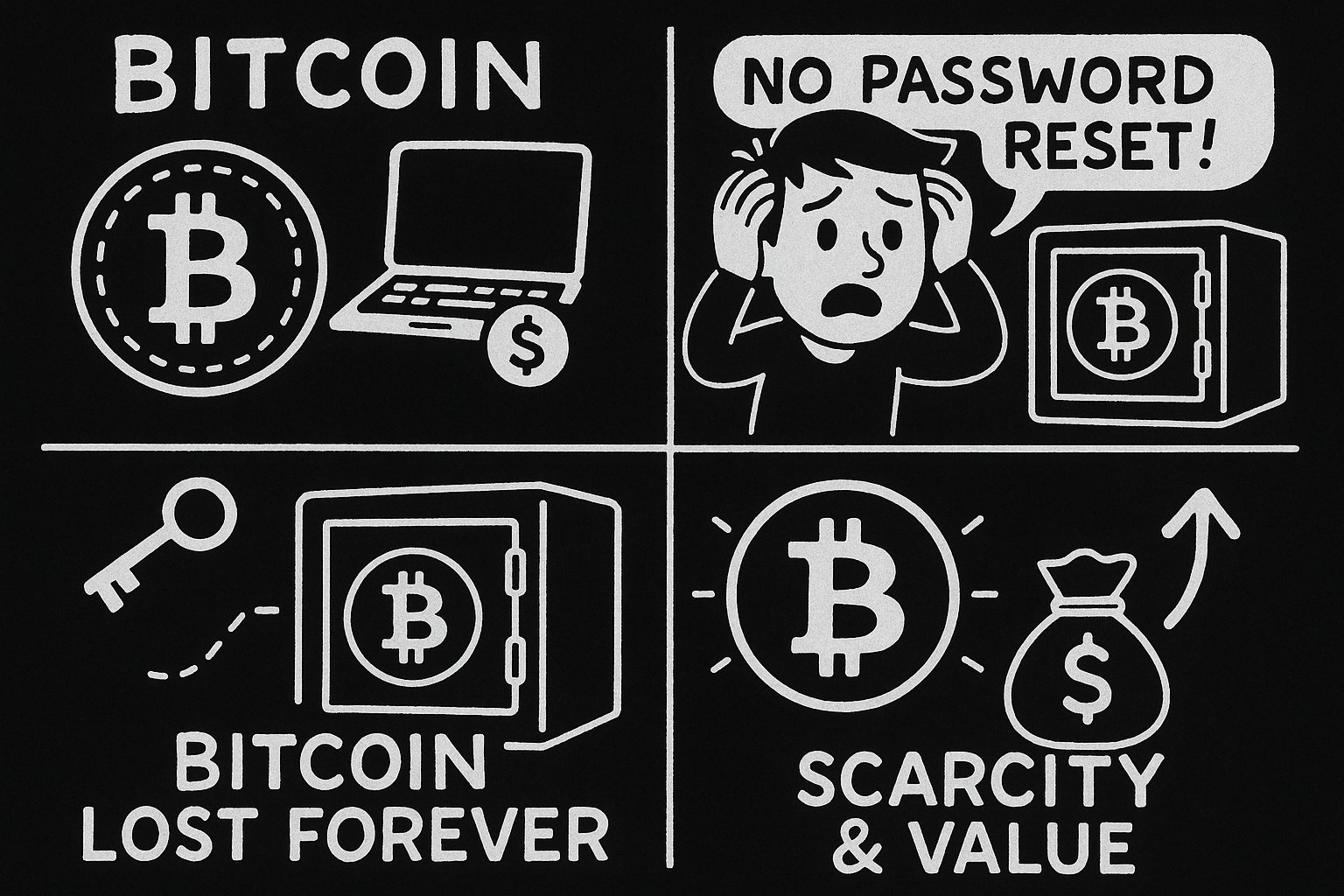

No Safety Net

No Central Authority

Bitcoin operates on a decentralized network, meaning there's no central authority like a bank that can reset your password or recover your account if you lose access. It's like having a super-safe, but if you lose the key, you're locked out forever.

When private keys are lost, the associated Bitcoin becomes permanently inaccessible. This reduces the total circulating supply of Bitcoin, which can contribute to its scarcity and potentially increase the value of the remaining coins.

Irreversible Transactions

Once a Bitcoin transaction is confirmed on the blockchain, it cannot be reversed. If you send Bitcoin to the wrong address or lose your private keys, those coins are gone for good. It's like sending a letter to the wrong address; once it's sent, you can't get it back.

----------------------------------------------

Wallet & Keys

If you're still scratching your head wondering what a Bitcoin wallet and keys are, just click here - no secret decoder ring needed!

Or Using Centralized Exchanges ?

Using a centralized exchange is like trading with an online broker-perfect for beginners and super easy to start. Just sign up, show your ID (KYC stuff), deposit some cash or crypto, and you’re ready to roll. The website or app is so user-friendly, buying and selling feels just like playing the stock market!

Using a CEX is like putting your money in a bank-easy and hassle-free, no need to worry about private keys (“no keys, no coins!”). But if the bank gets robbed (hackers) or goes bust, your money might just disappear into thin air. The perks? It’s super convenient, liquid, and follows the rules (KYC, anti-money laundering), so if things go south, you can try calling the lawyers. The downside? You’re putting all your eggs in one basket, creating a single point of failure, plus you have to deal with withdrawal limits and giving up some privacy. In short, it’s easy but you gotta trust the bank-because you’re basically handing your cash to someone else and hoping they don’t mess up!

So, is a centralized exchange really the newbie-friendly paradise they claim to be? Well, take a look at Coinbase Hack Attack and Bybit's Big Heist.

Cautionary Tales

Let's take a peek at the misadventures of those careless Bitcoin investors – what kind of hilarious mishaps have they gotten themselves into?

James Howells' Trash Adventure

The Guardian: Judge halts attempt to retrieve £600m bitcoin wallet from Welsh dump

James Howells accidentally threw away a hard drive with the private keys to 8,000 Bitcoins. He tried to dig it out of the trash dump, but it was gone forever. Now those Bitcoins are worth millions, but he can't get them back. Talk about a trashy mistake!

Coinbase Hack Attack

The Record: Hackers bypass Coinbase 2FA to steal customer funds

Imagine waking up to find your Coinbase account has been hacked, and all your crypto is gone! That happened to a poor guy whose account was breached, even with two-factor authentication. Coinbase said it wasn't their problem and told him to call the cops. The user was left wondering if it was an inside job.

Bybit's Big Heist

Reuters: FBI says North Korea was responsible for $1.5 billion ByBit hack

In 2025, Bybit got hacked in a massive crypto heist worth $1.5 billion in Ethereum. Hackers used a sneaky trick to get into Bybit's system through a free cloud storage service. They quickly moved the stolen crypto to other wallets and cashed out. It turned out the hack was linked to North Korea's Lazarus Group. Who knew hackers could be so sneaky?